22 Oct 2015 The Voice: Election 2015 – Tallying the Results

Earlier this week, the Liberal party won a decisive majority in the federal election of 2015. With nearly 17 million voters, Election 2015 saw the highest voter turnout in more than 20 years. While historic in many respects, the results signalled a shift in economic policy that would see increased spending on infrastructure, jobs and training, the environment and clean energy in the next few years.

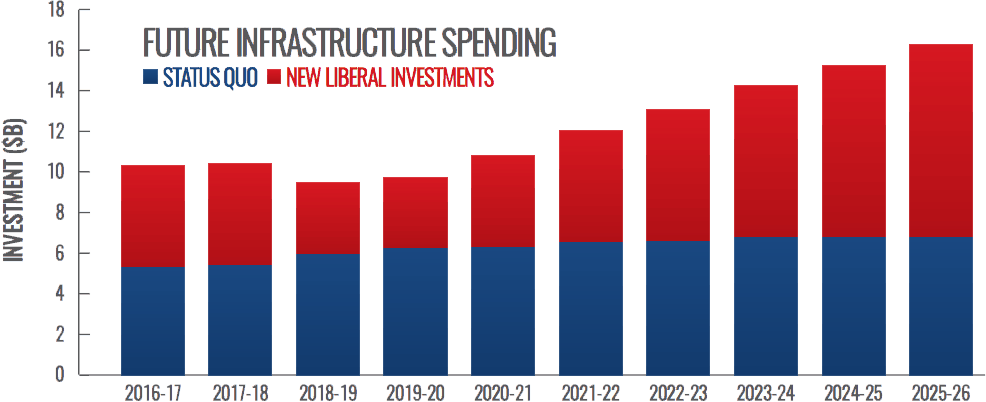

Among the most significant aspects of the Liberal platform was the plan to invest in the economy by operating deficits of $10 billion for the next two years, regaining a balanced budget in 2019.

Thematically, we believe the planned investments are indicative of a move towards more direct (versus indirect) measures in strategic areas of the economy. We are encouraged to see that the platform outlines a series of spending measures directed at supporting the growth of the technology and innovation sector and includes:

- Additional Investment in Ecosystems and Clusters. The plan calls for an investment of $200 million each year towards the expansion of incubators and accelerators, business innovation networks and cluster support.

Increased Funding for NRC-IRAP. The plan calls for an additional $100 million per year in funding in the Industrial Research Assistance Program to offer further support for startups and SMEs in the innovation sector.

Investments in Cleantech. The government plans to invest $100 million per year in support of clean technology producers and $200 million more each year to support innovation and the use of clean technologies in the natural resource sectors, including the forestry, fisheries, mining, energy, and agricultural sectors.

Restored Support for Labour Sponsored Funds. The government plans to reinstate the tax credit for contributions made to labour-sponsored funds which were set to be phased out by 2017 under the previous Conservative government.

Investments in the Creative Sector. The plan calls for increased funding for Telefilm and the National Film Board of $25MM per year.

Tax Measures

To fund these programs (and others), the platform calls for tax measures to partially offset the increases in spending over the next several years. The tax revenue plan calls for the replacement of the Universal Child Care Benefit, the cancellation of family income splitting, the cancellation of the increase of TFSA limits from $5500 to $10,000 and the introduction of a new tax bracket of 33 per cent for individual incomes in excess of $200,000 per year.

There is one tax measure in particular that is of concern to the tech industry in BC – the proposed cap on stock option deductions.

As outlined in the BCTIA’s 4-Point Plan, Attracting Talent remains one of the key elements in accelerating the growth of the tech industry in British Columbia and in Canada. The platform proposes to set a $100,000 cap on the amount that can be claimed through the stock option deduction. While larger companies and in particular public companies, have moved to Restricted Stock Units (RSUs) and other forms of compensation, stock options remain an essential component in the compensation structure for early stage tech companies in attracting talent.

We believe the proposed annual cap of $100,000 will be problematic and should be revisited for several reasons.

- Stock option gains for early stage companies are one-time events. Unlike the case of large public companies where stock option gains may be realized over many years, employees of early stage companies typically realize their stock option gains as a result of a one-time event – an IPO or an acquisition of the company. In such instances, it may take many years to realize this outcome, meaning that setting an annual cap is incongruous with the nature of how stock option gains are actually realized for startups and early stage companies.

- Diminishing Canadian competitiveness. Canadian startup and early stage tech companies compete vigorously with their US counterparts for talent – and the compensation formula is an essential part of the competitive matrix. With comparatively lower salary compensation levels in Canada, stock options have been an essential tool in bridging the difference with US companies. As there is no cap on stock option deduction eligibility in the US, any plans to enact a cap on the stock option deduction will undoubtedly exacerbate the compensation challenge for Canadian companies in their quest to attract talent.

The next few years holds significant promise for the tech sector in BC and across Canada. We are encouraged to see the broad direction signalled in the policy platform in support of the knowledge economy to capitalize on this opportunity. Over the next few months, we will begin to work actively with the new federal government to shape the policies that will support the continued growth of the tech industry to realize its full potential.

A full copy of the new Liberal government’s platform can be found here.