16 Feb 2015 The Results are In: BC Punching Above its Weight in Venture Capital

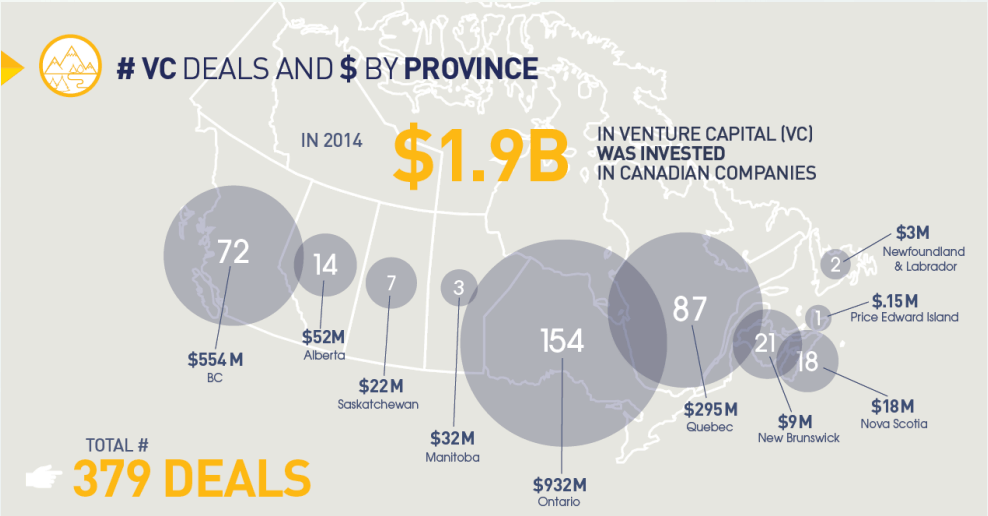

Last week, our friends at CVCA published their summary report for venture capital activity in Canada in 2014. According to their data, out of the 379 deals and $1.9 billion that was raised in Canada in 2014, BC accounted for 19% of all deals and a whopping 29% of all dollars raised.

We conferred with our experts – Brent Holliday @ Garibaldi Capital and Kathy Butler @ CIBC World Markets – who, along with their teams, poured over the data and shared a comprehensive analysis of what happened in 2014. While the numbers did not exactly match with CVCA’s data, 2014 was another stellar year for capital raising in BC with $477.8m in investment in BC technology companies. This was a significant increase over a very strong 2013 and was the highest level recorded since the dot com days.

nnSource: Garibaldi Capital Advisors, 2015

Although the results were overall very strong, it’s also worth noting the nuances. The stages of the venture capital financing were decidedly uneven. Late stage venture, buoyed by the “Hootsuite Effect” of their monster financing in 2013, continued to be strong and accounted for the largest proportion of deals as well as the dollars raised in 2014. BuildDirect accounted for $80MM, Hootsuite $67MM, D-Wave $60MM, Zymeworks $30MM and Visier $28MM in a year that saw eleven companies raise more than $10MM (versus only 5 in 2013). In contrast, early stage, Series-A financings in BC accounted for less than 15% of all deals and there continues to be a growing concern on the availability of early stage venture capital in BC.

The full CVCA report can be accessed here.